- WHY THE ROI OF GREEN BUILDINGS MATTERS MORE THAN EVER

- FINANCIAL ROI: DO GREEN BUILDINGS REALLY COST MORE?

- ENVIRONMENTAL ROI: REDUCING YOUR FOOTPRINT AND LIABILITY

- OPERATIONAL ROI: RUNNING BETTER BUILDINGS WITH LESS HEADACHE

- STRATEGIC ROI: FUTURE-PROOFING AGAINST MARKET SHIFTS

- CONCLUSION: DOES THE ROI OF GREEN BUILDINGS REALLY PAY OFF?

WHY THE ROI OF GREEN BUILDINGS MATTERS MORE THAN EVER

As construction costs rise and ESG (Environmental, Social, Governance) pressure increases, investors, developers, and project managers are asking one critical question: Do green buildings really pay off? The term “green” is everywhere—from LEED certifications to net-zero targets—but without clear returns, many stakeholders hesitate to embrace sustainable design. Time, budget, and uncertainty become the excuses to stick with traditional approaches.

But here’s the truth: green buildings aren’t just about saving the planet. They’re about increasing property value, reducing long-term costs, and future-proofing your assets.

According to the World Green Building Council, green buildings can reduce operational costs by up to 30% and increase asset value by as much as 7%. Yet these benefits are often overlooked at the planning phase due to misconceptions around ROI.

This post cuts through the greenwashing. We’ll break down the real ROI of green buildings—financially, operationally, environmentally, and strategically. And yes, we’ll show you how to make sustainability pay off.

FINANCIAL ROI: DO GREEN BUILDINGS REALLY COST MORE?

What the Numbers Say

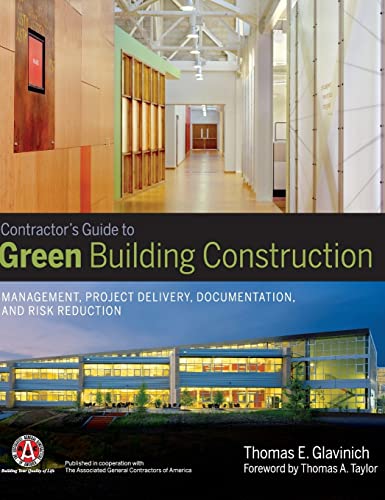

The initial cost of a green building is typically 1–5% higher than a conventional one. However, operational savings quickly offset this premium. A 2023 report by the U.S. Green Building Council (USGBC) shows:

- Energy savings: up to 25–30% annually

- Water efficiency gains: up to 20%

- Lower maintenance costs: 10–20% over 10 years

- Rental premiums: 5–11% in Class A markets

For example, the Empire State Building retrofit resulted in $4.4 million in annual energy savings after a $20 million investment.

Practical Financial Tips

- Incentivize smartly: Tap into local or federal grants for LEED or WELL certifications. Many jurisdictions offer property tax abatements, fast-tracking permits, or utility rebates.

- Use life-cycle costing: Don’t just look at CAPEX. Consider energy, maintenance, and insurance costs over 20–30 years.

- Pre-sell sustainability: Market green credentials early in your project to attract ESG-focused investors and tenants.

Benefits vs. Risks

Benefits:

- Lower OPEX

- Higher property valuation

- Attract premium tenants

Risks:

- Upfront cost can deter short-term-focused investors

- Poor execution of sustainable systems can nullify savings

ENVIRONMENTAL ROI: REDUCING YOUR FOOTPRINT AND LIABILITY

Real-World Impact

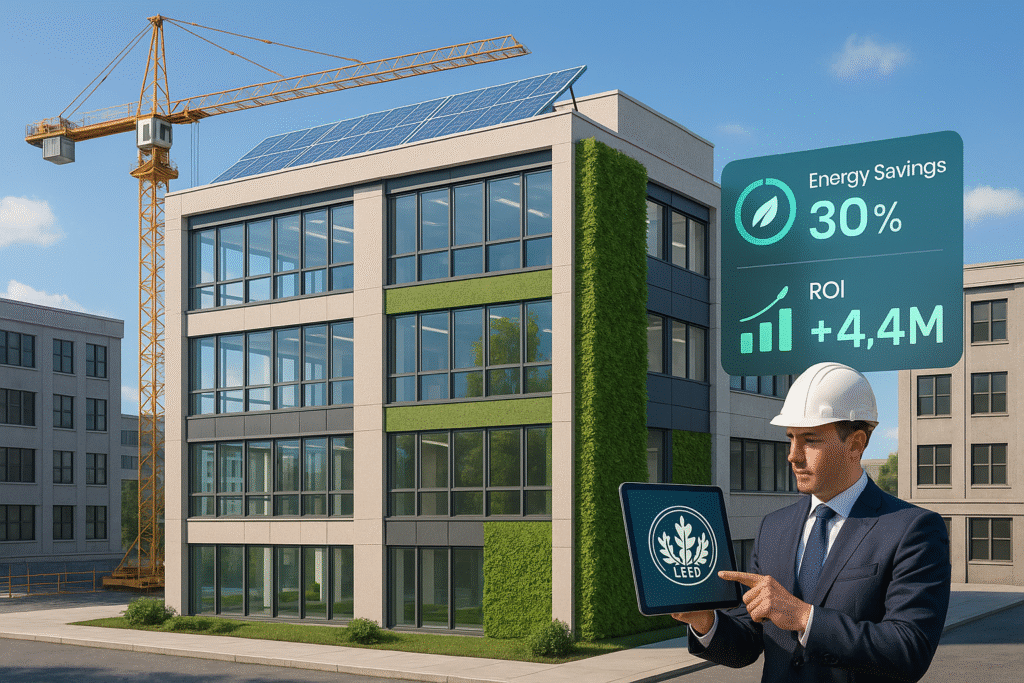

Green buildings reduce greenhouse gas emissions significantly. According to the World Green Building Council:

- LEED-certified buildings produce 34% fewer CO₂ emissions

- Buildings account for nearly 40% of global energy-related emissions

By reducing energy use intensity (EUI), firms not only cut emissions but also reduce exposure to future carbon taxes and regulatory penalties.

For example, Google’s Bay View Campus achieved net-zero operational emissions, using solar skin panels and geothermal piles—a model now influencing future tech campuses.

Actionable Environmental Strategies

- Focus on passive design: Prioritize orientation, insulation, and natural ventilation before jumping to expensive tech.

- Electrify early: Replace gas systems with electric alternatives to align with grid decarbonization trends.

- Set embodied carbon goals: Track emissions from materials like concrete, steel, and glass via tools like EC3.

Benefits vs. Risks

Benefits:

- Lower emissions and pollution

- Compliance with ESG frameworks (GRESB, CDP, etc.)

- Mitigation of climate regulation risks

Risks:

- Greenwashing backlash if claims are unverified

- Long-term targets may shift, making current measures outdated

OPERATIONAL ROI: RUNNING BETTER BUILDINGS WITH LESS HEADACHE

Performance Gains You Can Measure

Operational ROI is often the most tangible. Better-performing buildings use less energy, water, and manpower to run. According to a GSA study:

- Green buildings had 13% lower maintenance costs

- Occupant satisfaction was 27% higher

- Productivity increased due to better air quality and daylighting

Take the Bullitt Center in Seattle—it runs on 100% solar power, composts its waste, and uses rainwater for all non-potable needs. Operating costs? Near zero.

3 Smart Operational Upgrades

- Automate energy tracking: Use IoT sensors and dashboards to detect inefficiencies in real time.

- Design for flexibility: Adaptable floor plans extend asset life and reduce renovation waste.

- Use low-maintenance materials: Opt for materials with high durability and low VOCs to cut costs and improve indoor air quality.

Benefits vs. Risks

Benefits:

- Reduced utility and maintenance costs

- Higher tenant satisfaction and retention

- Easier building operations with automation

Risks:

- Overly complex systems may confuse facility managers

- Faulty tech (e.g., sensors, BMS) can negate expected savings

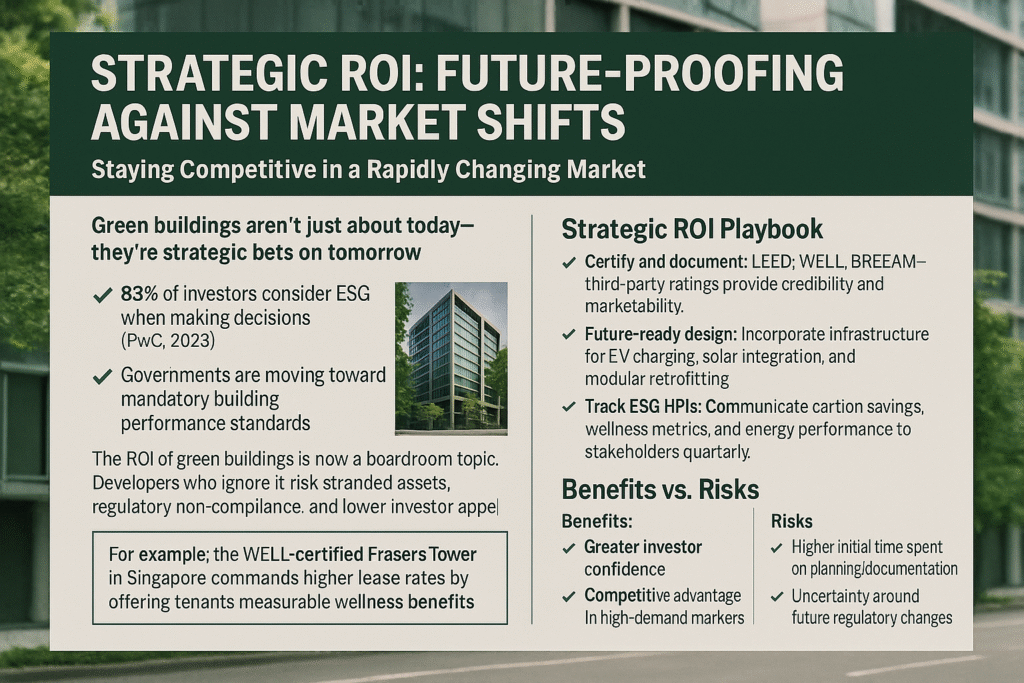

STRATEGIC ROI: FUTURE-PROOFING AGAINST MARKET SHIFTS

Staying Competitive in a Rapidly Changing Market

Green buildings aren’t just about today—they’re strategic bets on tomorrow.

- 83% of investors consider ESG when making decisions (PwC, 2023)

- Governments are moving toward mandatory building performance standards

- Green real estate funds are outperforming traditional portfolios

The ROI of green buildings is now a boardroom topic. Developers who ignore it risk stranded assets, regulatory non-compliance, and lower investor appeal.

For example, the WELL-certified Frasers Tower in Singapore commands higher lease rates by offering tenants measurable wellness benefits.

Strategic ROI Playbook

- Certify and document: LEED, WELL, BREEAM—third-party ratings provide credibility and marketability.

- Future-ready design: Incorporate infrastructure for EV charging, solar integration, and modular retrofitting.

- Track ESG KPIs: Communicate carbon savings, wellness metrics, and energy performance to stakeholders quarterly.

Benefits vs. Risks

Benefits:

- Greater investor confidence

- Competitive advantage in high-demand markets

- Lower risk of obsolescence

Risks:

- Higher initial time spent on planning/documentation

- Uncertainty around future regulatory changes

CONCLUSION: DOES THE ROI OF GREEN BUILDINGS REALLY PAY OFF?

Yes—when done right, green buildings deliver meaningful ROI across every dimension. Financially, they reduce long-term costs and improve asset valuation. Operationally, they simplify management and increase tenant satisfaction. Environmentally, they slash emissions and prepare projects for future policy shifts. Strategically, they future-proof assets and attract premium capital.

But here’s the key: the ROI of green buildings only pays off if sustainability is embedded from the start—not tacked on at the end.

Next steps?

If you’re a developer or investor, start by benchmarking your current and future assets using tools like Energy Star Portfolio Manager or LEED Zero. If you’re managing a portfolio, ensure every building has a roadmap toward operational efficiency, certification, and emissions reporting.

The ROI of green buildings isn’t a guess—it’s measurable, trackable, and bankable.

🚧 Need expert help? → Book a 1:1 consultation for your construction project management, planning, or automation challenges.

📚 Looking for powerful industry reads? → Visit my recommended books page for construction, leadership, and tech picks.

👷 Want gear and tool suggestions? → See my recommended gear list.

📬 Join the inner circle → Subscribe to the newsletter and get actionable project tips every week.

🌍 Explore my global experience → View projects I’ve contributed across 7 countries, including mega-developments and complex infrastructure work.

🔗 Stay connected → Follow me on LinkedIn for daily insights, behind-the-scenes breakdowns, and expert construction management content.